Part 1: Corrections to Previous Analysis

1. Orchids Performance Issue Clarification:

⦁ The poor performance in Round 3 was NOT due to IMC changing bot behavior (as previously speculated)

⦁ After discussion with teammates, confirmed the real reason was insufficient import tariffs leading to limited arbitrage opportunities

⦁ Verification test: Keeping ASK at best BID+1 position still generated significant trading volume (though resulted in consistent losses)

2. Backtest Results Adjustment:

⦁ The previously reported 30k+ profit appears overfitted

⦁ Issue: Used imsample-fitted implied volatility which doesn’t generalize well

⦁ Better approach: Using 3-day average volatility shows more stable (though lower) results

⦁ Current testing: Experimenting with exponential moving average (EMA) implied volatility for fair price calculation

⦁ Additional note: Still haven’t figured out optimal use of sunlight and humidity data

⦁ Decision: Will maintain current coconut strategy while refocusing on Orchids improvement

Part 2: Manual Trading Strategy for Current Round

Key Variables:

⦁ Personal low bid

⦁ Personal high bid

⦁ Market average high bid

Core Rules:

⦁ If personal high bid > market average: No PNL penalty

⦁ If personal high bid < market average: PNL penalty applies

⦁ Conclusion: Should strategically increase both bid prices

Optimal Bidding Strategy:

⦁ Mathematical relationship derived from payout formula derivative:

Optimal low bid = (2/3) × high bid

⦁ Implementation steps:

(1) Estimate market average high bid

(2) Set personal bids as:

⦁ Low bid = (2/3) × estimated average

⦁ High bid = 1 × estimated average

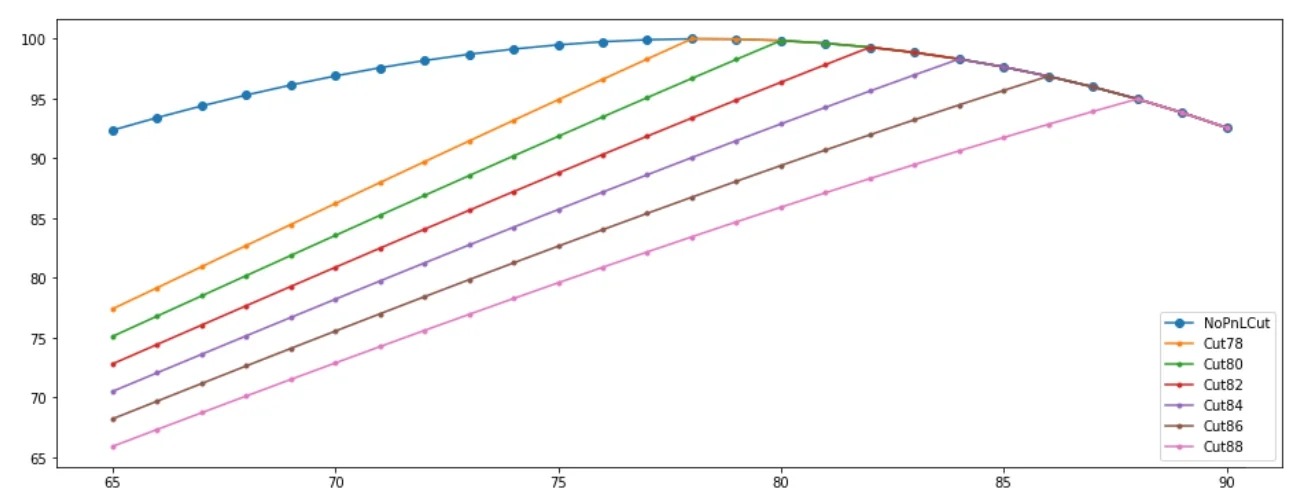

Sensitivity Analysis (Refer to the Figure):

⦁ X-axis: Our high bid value

⦁ Y-axis: Payout percentage relative to previous round’s optimal solution

⦁ Key observations:

(1) Without PNL cut, optimal high bid = 78

(2) Optimal bid increases with rising market average

(3) When low bid is optimal, high bid changes have minimal PNL impact

(4) Near 78, PNL shows low sensitivity to bid changes (small first-order derivative)

Practical Recommendation:

⦁ Submit slightly higher than calculated high bid

⦁ Reasoning:

⦁ Reduced sensitivity near the 78 threshold

⦁ More conservative approach against potential underestimation of market average