Round 2 was extremely time-constrained. For the algorithmic portion, my approach was essentially as described in my previous post. The manual trading component, however, proved more tricky.

The manual trading mechanism worked as follows:

⦁ Each participant submits a price between 9000 and 11000

⦁ If your price is below the median of all submissions, you get to trade

⦁ You sell at your submitted price and buy back at the average price of all qualifying traders (those below median)

⦁ The trade quantity is fixed at 300

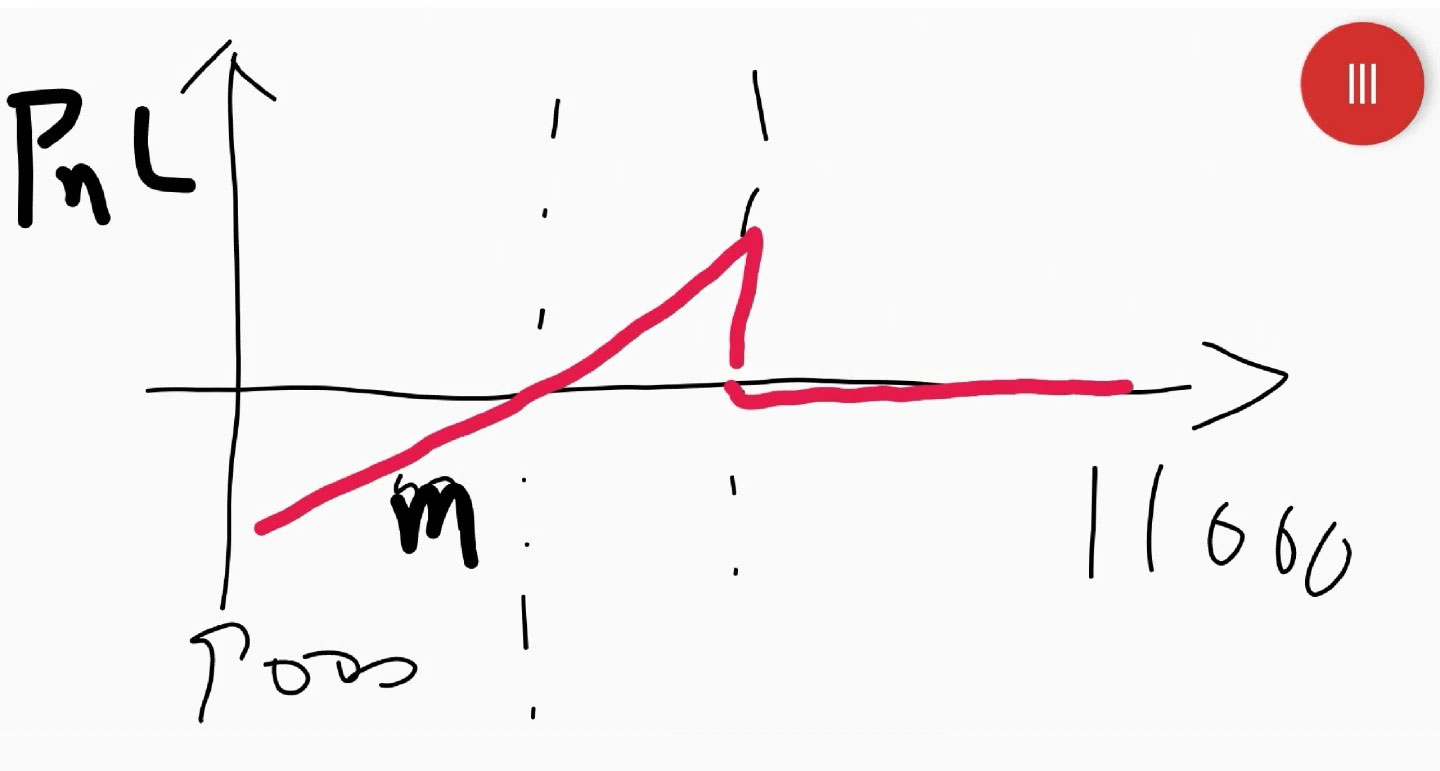

Theoretically, the optimal strategy is to submit a price just below the median to maximize profits. The profit distribution follows this pattern.

This resembles the classic game theory problem of “guess 2/3 of the average,” where a Nash equilibrium exists but is nearly impossible to achieve in initial attempts. Research shows that in real-world experiments, results typically converge to about two levels of reasoning:

1. First-level: Uniform distribution → median at 10000, buyback at 9500

Profitable range: 9500-10000

2. Second-level: Assuming others think like first-level → median at 9750, buyback at 9675

Thus, submitting between 9675-9750 seems reasonable

However, Discord discussions revealed most participants planned to submit 10000+, as:

⦁ The Nash equilibrium is everyone submitting 11000

⦁ No individual has incentive to submit lower prices (would lose money)

This makes the actual outcome harder to predict

Round 2 will likely reshuffle rankings significantly because:

1. Algorithmic trading:

⦁ Some may achieve huge profits by simply betting on price movements

⦁ Conservative pair trading might cap at ~50k

2. Manual trading:

⦁ High luck factor – guessing right could yield 250 profit × 300 = 75k

⦁ Typical algorithmic profits per round are only ~30k