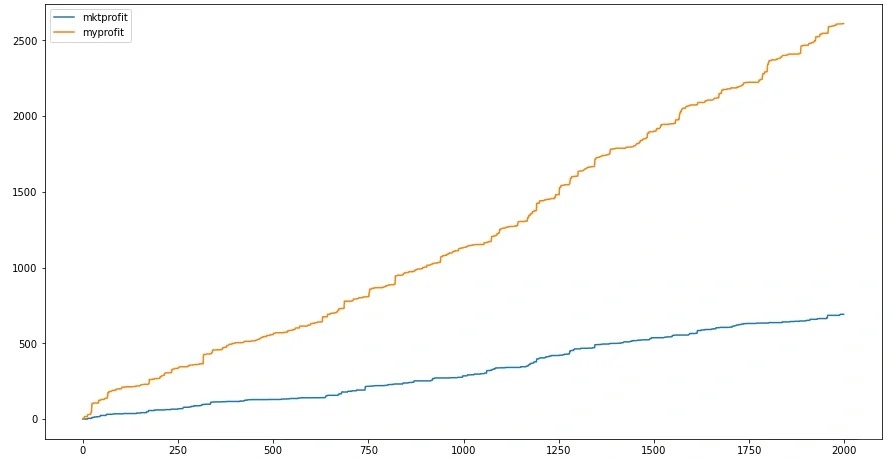

Today I focused on comparing my performance against other market participants in bananas trading to identify improvement opportunities. Here’s my analysis approach:

1. Profit Tracking Methodology:

⦁ For all market trades reported by exchange:

PnL = abs((trade_price – fair_price) * quantity)

⦁ For my own trades:

PnL = (fair_price – trade_price) * quantity

⦁ Plotted cumulative sums of both PnLs

Key Finding: My algorithm missed ~700 in potential profits based on the gap between these curves.

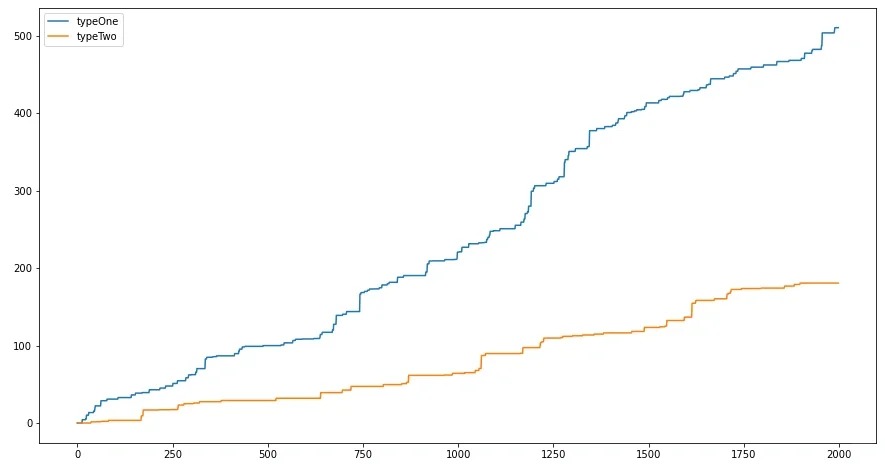

2. Market Trade Breakdown:

I categorized missed opportunities into two types:

⦁ Type 1: Trades executed outside my bid-ask spread (or exactly at my quotes)

Related to those mysterious “phantom trades” from previous research

Currently unsolvable until we crack that anomaly

⦁ Type 2: Trades executed within my spread when position limit wasn’t full

Caused by having too wide bid-ask spreads

3. Optimization Attempt:

Narrowed my bid-ask spreads to capture more Type 2 trades

Result:

Reduced Type 2 missed trades (success)

But overall profits decreased because other trades became less profitable

Similar pattern observed in pearls trading

Conclusion: There’s a delicate balance between:

✔ Capturing more trades by tightening spreads

✔ Maintaining profit margins on executed trades

The 700 gap suggests I need smarter dynamic spread adjustment rather than simple narrowing.