Round 3 Performance

Final Ranking: #27 (improved from previous round)

Key Results:

1. Manual Trading:

⦁ Selected positions: J26 (58k profit) and G30 (60k profit)

⦁ Inviting others to share their selections/profits in comments for comparison

2. Algo Trading:

⦁ Market making products: 30k profit

⦁ Orchids: Disappointing 5k profit (vs 460k in Round 2)

⦁ Basket trading: 60k profit

Critical Issue Identified:

⦁ Orchids’ previous high profits were caused by IMC’s problematic bot behavior

⦁ Bots were overly aggressive in taking bids/asks, artificially inflating arbitrage profits

⦁ Issue wasn’t fixed in Round 2 test data, but silently corrected for Round 3 live competition

⦁ Significant time wasted optimizing for flawed conditions

Round 4 Strategy: Coconuts & Coconut Coupons

Market Analysis:

⦁ Both products show very tight bid-ask spreads (1-2 range)

⦁ Conclusion: Market making not viable → Focus on taking positions

Pricing Framework:

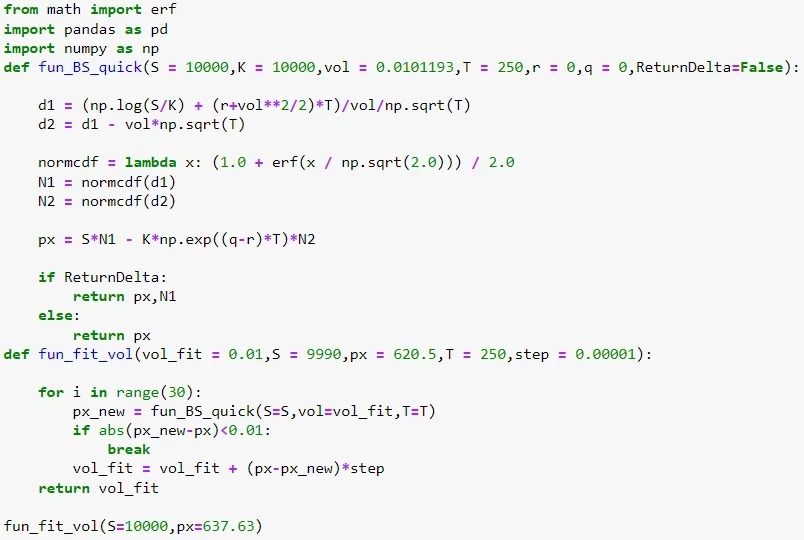

⦁ Using Black-Scholes model for coconut coupon pricing

⦁ Two key applications:

(1) Calculate theoretical coupon price using coconut price and implied volatility

(2) Derive implied volatility from market prices using gradient descent

(See Figure for implementation code)

Trading Strategy:

1. Fit implied volatility from historical data

2. When coupon price deviates significantly from fair value:

⦁ Take opposite position in coupons

⦁ Implement delta hedge with coconuts

⦁ Hedge ratio: -delta × position size

3. Example trade:

⦁ Fair value = 670

⦁ Delta = 0.5

⦁ Market coupon price: 662/663

⦁ Action: Buy 10 coupons at 663 + Sell 5 coconuts

Current Performance:

⦁ Backtest shows ~30k profit

⦁ Additional parameter optimization possible

Manual Trading Preview:

⦁ Game theory version of previous goldfish game

⦁ Detailed analysis to follow in next update

Final Notes

(1) Despite Orchids disappointment, overall ranking improved

(2) Coconut strategy shows promise but requires refinement

(3) Encouraging community data sharing for manual trades

(4) Will continue to monitor for any undisclosed rule changes

Safe trading to all competitors!